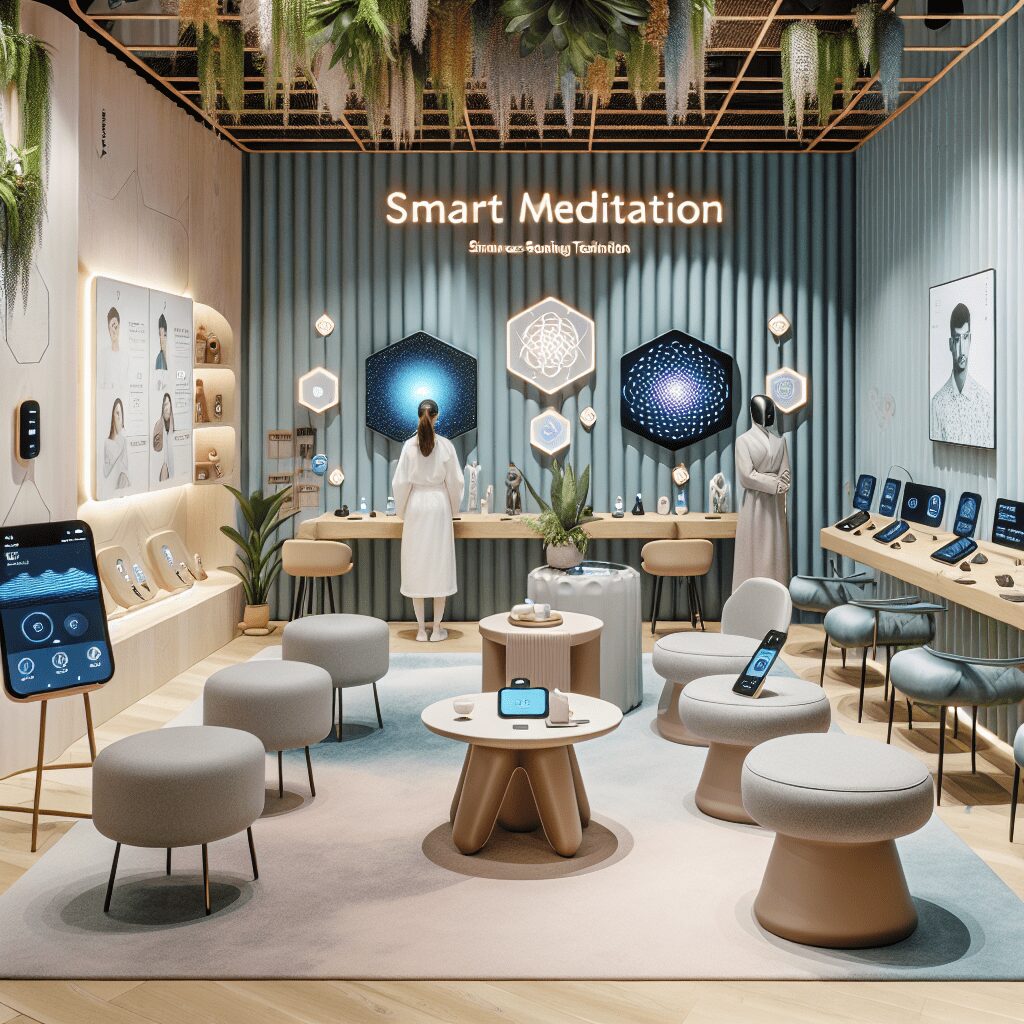

Prioritize your mental well-being daily. Enhance your life by nurturing your mental health with the Smart Meditation app. Break free from stress, alleviate anxiety, and enhance your sleep quality starting today.

Is Anxiety A Pre Existing Condition?

Navigating the Waters of Anxiety as a Pre-existing Condition

Let’s dive straight into the heart of the matter, shall we? When it comes to health insurance and medical conditions, the term “pre-existing” can feel like navigating through a murky swamp. It’s tricky, complicated, and let’s be real, a tad overwhelming. But, fear not! We’re about to embark on a journey to demystify this topic, especially when it concerns anxiety—a condition that has been riding shotgun with humanity for as long as anyone can remember.

Anxiety: The Unseen Baggage

First off, what’s the deal with qualifying anxiety as a pre-existing condition? Well, spoiler alert: It’s a bit of a gray area. While anxiety disorders are one of the most common mental health issues worldwide, affecting millions, the classification hinges on a few key factors.

-

When the Diagnosis Cricket Chirps: If you’ve been diagnosed with an anxiety disorder before signing up for a new health insurance policy, then bingo, it might be considered pre-existing. This is because insurance companies often look at your medical history to determine if your condition was on the roster before you joined the team.

-

The Waiting Game: Some policies include waiting periods for pre-existing conditions. This means if your anxiety was diagnosed before you were covered, you might have to wait a bit before your treatment or medication for anxiety is covered under the policy. It’s like being put on hold, but for healthcare.

-

A Silver Lining Playbook: Thanks to modern regulations in many places, like the Affordable Care Act (ACA) in the United States, the narrative is changing. These regulations often prevent insurance companies from discriminating based on pre-existing conditions, including mental health conditions like anxiety. It’s a step in the right direction, ensuring that your mental health is given the same priority as your physical health.

Tips to Navigate the Murky Waters

If you’re feeling like you’re between a rock and a hard place, here’s how you can navigate these waters:

-

Knowledge is Power: Before you dive into a new policy, make sure you’ve got all your ducks in a row. Understand what the policy says about pre-existing conditions and mental health coverage. It’s about getting to the nitty-gritty, leaving no stone unturned.

-

Seek Professional Guidance: Sometimes, it feels like you need a decoder ring to understand insurance jargon. This is where professionals come in handy. A chat with an insurance broker or a mental health advocate can shed light on the best path forward for you.

-

Advocacy Looks Good on You: Become your own best advocate. If you think a decision about your coverage was off the mark, don’t shy away from appealing it. Remember, the squeaky wheel often gets the grease.

-

Prevention, Not Just Prescription: While insurance is a critical piece of the puzzle, remember that there are a plethora of resources and techniques available to help manage anxiety. From mindfulness and exercise to joining support groups, these strategies can complement your treatment plan beautifully.

To wrap it up, while anxiety may play hide-and-seek with the label of a pre-existing condition, there’s a growing acknowledgment and support for mental health in the realm of insurance. By staying informed, advocating for yourself, and utilizing both clinical and self-help resources, navigating the constraints of pre-existing condition clauses can become more manageable. Remember, you’re not just a policy number—you’re a person deserving of comprehensive healthcare, anxiety, and all.