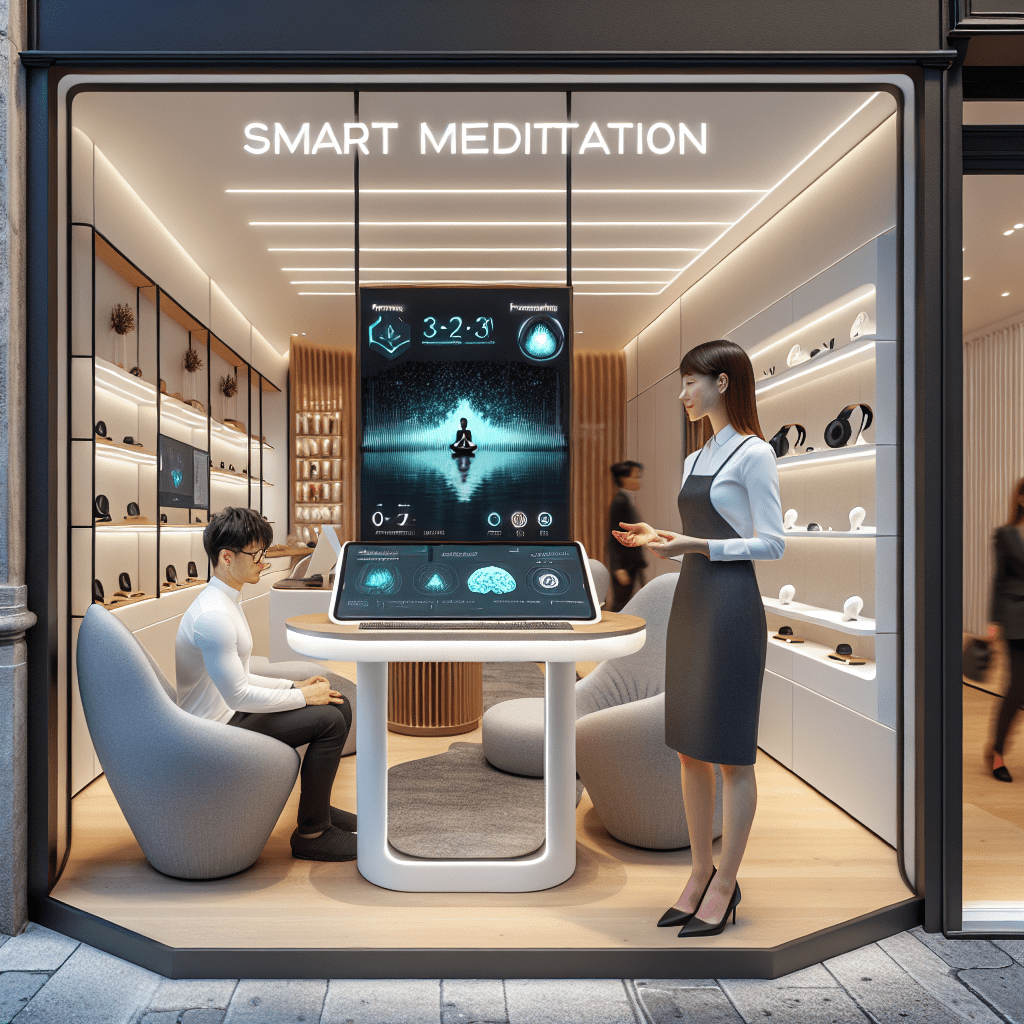

Prioritize your mental well-being daily. Enhance your life by nurturing your mental health with the Smart Meditation app. Break free from stress, alleviate anxiety, and enhance your sleep quality starting today.

Investment Reflection

Unveiling the Art of Investment Reflection

Embarking on the journey of investing can often feel like navigating a labyrinth, riddled with opportunities and pitfalls. But here’s the kicker—it’s not just about throwing your money into the stock market and hoping for the best. Nah, it’s more nuanced, more intricate. It’s about stepping back, taking a breather, and indulging in a bit of what we call ‘Investment Reflection’.

The Why and How of Reflective Investing

So, why on earth should you hit the pause button and engage in this so-called investment reflection? Well, first off, it’s a golden opportunity to align your investment strategies with your financial goals and risk tolerance. Think of it as a pit stop in the race, allowing you to check your investment vehicle, tweak your strategies, and ensure you’re on the right track.

Here are a few steps to get you into the groove of reflective investing:

-

Moment of Truth: Start by evaluating your current financial situation. Dust off those old portfolio statements and give them a good once-over. Are your investments still in line with your financial goals? If not, it might be time for some rejigging.

-

Risk Tolerance Reckoning: Has the thrill of the gamble taken over, or has a recent market downturn left you sweating? Reflect on your risk tolerance. It might have evolved since you first dipped your toes into the investment waters.

-

Performance Pulse Check: How are your investments actually performing? This isn’t just about looking at the numbers. It’s about understanding the why. Dive into the reasons behind the performances and consider if they align with your expectations.

-

Knowledge is Power: The world of investing is ever-changing. New trends, sectors, and opportunities emerge while others fade away. Use your reflection period to hit the books (or reputable online sources). Brushing up on your investment knowledge can unveil new strategies or opportunities.

Turning Reflection into Action

Reflecting is great, but it ain’t worth a dime if you don’t act on your insights. So, once you’ve had your Eureka moments, sketch out a plan. Whether it’s rebalancing your portfolio, setting new financial goals, or exploring new investment avenues, the key is to move forward with purpose and a clear strategy.

Wrapping It Up with a Bow

Let’s circle back to where we started. Investment reflection might seem like a fancy term, but it’s essentially about being mindful of your investment journey. It’s about making informed decisions rather than chasing the wind. In the grand scheme of things, regular reflection can be the compass that keeps you on course in the tumultuous seas of investing.

So, here’s a parting thought—why not make investment reflection a ritual? Like the changing seasons or the ticking of the clock, let it be a scheduled pause for introspection and strategic recalibration. Who knows? It might just be the secret sauce to your financial success.